沉思嚴肅的問題

這兩天金融市場上發生了一連串看似巧合,卻又讓我覺得一定不是巧合的事件,讓我開始努力要找出原因

1. 黃金崩跌 2. 英鎊閃崩 3. 人民幣離岸匯率大貶 4. 美元對日元狂升 5. 美國10年國債利率悄悄上升

---- 全都指向美元強勢,但看美元指數又還好,並沒有狂升到哪去...

結果發現了一件很重大的事,或許是我孤陋寡聞,但我真的一直不知道的事 ----10月14日,美國將實施新的貨幣基金監管新規,這會導致全球數千億美元回流美國

接下來是幾篇相關分析文章,是一個叫做黃生的人寫的,POST 出來大家一起討論,或許有人會認為危言聳聽,但我到有些相信了。

因為我覺得,似乎有些事,正在悄悄發生... 這讓我,似乎看到一些光,可是還模糊不清,需要甩甩腦袋,想想下一步的投資策略。甚至,未來幾天考慮把"重倉"在陸股基金的錢,想先退出觀察,改天投資美國房地產指數或股票...

"離10月14日越近,境外美元回流美國就越迫切,這個時候英國倫敦就成為漩渦中心,貨幣基金在大量買進美元,同時拋售英鎊,然後回流,這必然導致英鎊大跌,而且會引起連鎖反應,也就是英鎊隨時可能閃崩。

而且在這種情況,歐盟也跟著落井下石,隨著英國首相表示強硬退歐,法國總統公開表示要讓英國付出代價,也就是這個時候歐盟肯定也會跟風拋售英鎊,導致英鎊匯率下跌。

毫無疑問,當前的美國、歐盟導演了英鎊的下跌,現在英國將成為全球金融的漩渦中心之一,但是英鎊的狂跌,對英國的未來是好事,大家可以拭目以待。

人民幣是另一大主角,也是另一個漩渦中心,在舉國慶祝人民幣加入SDR之時,人民幣離岸匯率卻連續下跌,跌破6.7之後,創下了9個月新低。

但是,接下來人民幣匯率的走勢將變得非常微妙,也將反應中國的人民幣匯率戰略,接下來有兩種可能:

1、人民幣要護盤人民幣匯率很容易,因為人民幣境外的流動性很小,只要稍微出手,一點點的買盤,就可以讓人民幣匯率走高,甚至可以非常輕鬆的屠殺人民幣空頭。

2、如果國慶後,中國並沒有護盤人民幣匯率,而是將中間價順勢下調,那麼說明中國認同了人民幣需要貶值。這個可能的走向將變得非常關鍵和重要。

回覆 金正夯:這兩天金融市場上發生了一連串看似巧合,卻...

國慶日期間,中國非常及時進行了一場波瀾壯闊的全國性的房地產調控,這是在當前房地產全民狂熱時代,突然澆下的一盆冰水,避免了一場大崩盤,避免了一次像2015年股災那樣的悲劇。這是一場金融大暗戰,是中國應對全球金融貨幣博弈,而主動採取的一次大戰略。

我們知道,任何一個國家被剪羊毛,最重要的戰場就是房市,因為這個市場會容納太多的財富和貨幣,一旦一個國家的房地產泡沫吹大到極致,最後破滅,導致大量財富外流,貨幣貶值,甚至引起嚴重的金融、經濟危機,基本上就宣告這個國家被剪羊毛了。

包括當年的日本,東南亞的泰國,香港等,都是因為房地產市場被爆,引起了重大的金融危機;還有2008年的美國次貸危機,實際上就是房地產泡沫破滅引起的。

而最近,美國、日本、歐盟都開始在暗中收緊貨幣,而且全是靜悄悄的,都想先發制人,讓別的國家為危機買單,讓別的國家被剪羊毛。

1、美國儘管沒加息,但是一直在悄悄退出QE,縮減美聯儲的資產負債表。10月14日開始實行的貨幣基金監管新規,通過改變規則,將境外的美元趕回美國,這是一場重大的陰謀。

2、美國通過這種方式在進行非常隱蔽的金融貨幣佈局,目的就在於接下來立於不敗之地,美聯儲官員甚至剛剛表示要先發制人加息,以免被動。在全球經濟並沒有恢復到次貸危機前,所有的財富不過是存量分配和爭奪,美國在嚴重的債務面前,必須要搶先爭奪全球財富流向美國。

3、同時非常陰險的是日本,剛剛提出了貨幣政策目標改變為不是寬鬆,而是將利率目標讓十年期國債盯住零收益率。幾乎所有人都忽略日本央行的真實目的,實際上就是將日本十年期國債收益率由負利率提高到零。

4、日本這一招非常毒,大家都明白日本是一直在寬鬆的道路上狂奔,如今卻悄悄改變了戰略,暗中進行了加息,而且要完成十年期國債收益率維持在零,就必須要縮減寬鬆規模,也就是說日本在暗中縮減QE。

5、也就是剛剛,西方的媒體曝光了歐盟一個秘密計畫,就是歐盟準備縮減QE,以每個月減少100億歐元的規模,回收貨幣。目前歐盟購債規模為每個月800億歐元,以一個月縮減100億歐元,這個縮減速度非常非常快。

6、歐盟這個秘密計畫一被彭博曝光,迅速引起了軒然大波,黃金瞬間暴跌跌,整個市場為之震動。

美國、日本、歐盟都在偷天換日,秘密提前進行縮減QE,回收流動性,都在想先發制人,而這種流動性回收的後果就是,剩下的寬鬆貨幣市場,將會受到重大的打擊和被剪羊毛。

如果當前的中國,任由房地產泡沫瘋狂發酵,任由國民無理性瘋狂,那麼後果必然是無比悲劇的,無疑會在美國、日本、歐盟加息或者回收貨幣之時,中國房地產泡沫會在瘋狂之極時突然被爆破,最後引發一系列的嚴重後果。

而在10月,中國發生了一件影響全球的大事,那就是人民幣加入SDR,而加入SDR的條件就是,人民幣必須是自由使用的貨幣,資本管制要放鬆。在這種情況下,如果任由房地產泡沫繼續吹大,一爆破,中國的財富就會因為人民幣加入SDR而導致相對自由寬鬆資本環境中,大量流向國外,中國就會成為危機的買單者,會被嚴重剪羊毛,導致非常嚴峻、嚴重、悲慘的局面。

在這種情況下,中國只能採取以下方法來規避:

1、中國緊縮貨幣,提高利率,減少貨幣供應量,這肯定是最好的方法,但是會誤傷實體經濟,因為當前中國的問題是房地產泡沫和投機貨幣過於氾濫,但是實體經濟還處於調整中,大量中小企業缺乏資金。

2、採取定向嚴格調控,將貨幣從投機領域和泡沫領域趕出,在中國,投機和泡沫領域毫無疑問是房市。

3、所以,這次中國大規模的房市宏觀調控,除了國內環境的分析,還少不了國際上非常複雜的形勢,各個國家都在暗中運籌帷幄,緊鑼密鼓的進行佈局。

美國、日本、歐盟、英國,一場全球性的貨幣收縮在悄悄的進行,各個國家都在偷天換日、瞞天過海,中國已經主動加入,就從上個星期回收流動性開始,更是從國慶期間,中國開始一場大規模的戰略性進行房市調控開始。

剛剛,中國避免了一場房地產被動型的崩盤,主動臥倒避免風險,而全球性的貨幣博弈才剛剛開始搶跑,一場殘酷的暗戰已經開始上演!

回覆 金正夯:這兩天金融市場上發生了一連串看似巧合,卻...

10月,美國馬上要實行貨幣基金監管新規,這必然會使得全球金融市場遭受史無前例的重大考驗,會導致大量的美元債務違約,導致大量的美元浩浩蕩蕩流向美國,從而掀起滔天巨浪。

美國的貨幣基金已經從日本流出了超過2000億美元;目前,歐洲各個國家向歐洲央行借入美元已經越來越難,借款利率越來越高;倫敦的美元拆借利率已經創下了八年來新高,只有次貸危機時才有如此高的記錄。形勢非常嚴峻!

這可以說是美國這幾年一個最重大的陰謀,或者說是陽謀,通過改變監管規則,就使得美國境外美元流向美國,導致離岸美元的拆借利率大幅度走高,引起全球美元的緊缺,來一場轟轟烈烈的剪羊毛。

這次10月開始實施的貨幣基金監管新規,要求貨幣基金實施浮動計價,同時對投資人贖回收取費用。

這樣一來,貨幣基金只敢投向流動性最好,安全程度最高的美國國債,過去投向境外商業銀行的票據等資產的行為將會大幅度減少,使得境外的美元會大幅度減少。

一旦境外美元大幅度減少,大量借了美元債務的企業將遭殃,因為他們將不得不面臨成本大幅度上升,甚至根本借不到美元的可能,到時候他們就償還不了美元債務。

這樣必然會導致大量的美元債務企業違約,會使得股市、債市出現大規模的違約行為,對股市、債市帶來巨大的衝擊。

據估計,全球至少會有7000億美元貨幣基金從境外市場撤退,這會使得很多國家、很多市場面臨巨大的美元流動性枯竭。

美國這一招非常絕妙,也非常毒辣,因為該貨幣基金的監管規則的改變早在2014年就開始制訂,也就是2014年美國就預想到了為了結束QE,必須採取美元回流的對策。

現在大量國家的央行在拋售美元,而且這種拋售是被動的,這些賣盤需要大量的資金去承接,讓境外美元回流的最好方法,就是這個貨幣政策的監管新規,第二是美聯儲加息。

一邊是半年以來,全球國家的主要央行大肆拋售了3000多億美元的美國國債,一邊是貨幣基金監管新規導致的總共超過7000億美元的回歸,不但順利承接了這些拋盤,還要重重的剪其它國家的羊毛。

同時這還將嚴重影響中國的房地產企業,大量的中國房地產企業在境外發行了美元債券,隨著美聯儲的加息,不但利率會提高,同時會因為到時候還美元債務,通過向境外拆借美元來償還貸款會變得越來越困難。

可以預見,這次全球性的美元性緊張,不但會導致股市、債市,甚至是很多國家的貨幣出現違約,也間接會影響到中國的房地產,影響範圍非常廣,是全球性的。

回覆 金正夯:這兩天金融市場上發生了一連串看似巧合,卻...

全球美元荒上演,很多國家接下來會出現很大的危機,尤其是美元外匯儲備薄弱的國家,還有大量美元負債的企業,必然在香港發行美元債券的中國房地產企業,接下來都會面臨很大的麻煩。

資金流出的地區,都會出現問題,不是股市問題,就是債市問題。包括歐洲、日本等資金大規模流出的問題,都將面臨巨大的考驗。還有新興市場國家,面臨嚴峻的資金外流,也將面臨巨大的困難。

同樣,資金流向哪裡,哪裡將存在機會,這是資金流動帶來的枯榮相生,全球資金尤其是美元回流美國,那麼全球最大的機會可能就在美國,機會在美國的股市?債市?房市?我認為美國的股市、債市都已經創下了史無前例的泡沫,而美國房市在次貸危機後一直去杠杆,將會是全球投資的一個價值地。

以上僅供參考 ....

回覆 單細胞:作個記號,回來慢慢看...

政治層面太高遠,不是我們市井小民能參與的…。我只認為,影響黃金9月底到10月初大跌的元凶是這隻黑天鵝:德銀現金儲備不足和德商銀裁員萬人、英鎊脫歐大跌相對美元走強所致、後續11月歐盟要清算外債到期的義大利銀行,義大利可能啟動公投脫歐反制。然後到12月美聯儲如果加息,10月到12月本來可能的黃金多頭漲勢就泡湯了,然後我怕我就被套牢在1310美元左右到明年3月前…,唉。美國改變境外貨幣監管法令來無形結束QE、歐盟打算年減百億美元國債、日本央行放棄低負殖利率日元止跌結束日本的貨幣寬鬆政策,都是至少一年以上才看得出效果的中長期影響因素。凱因斯說過,長期??長期來看,我們都死了!所以擔心中長期政策變化幹什麼?順利,我們12月就獲利或者停損了結出場了,不順利就是到明年3月,去它的貨幣戰爭和剪羊毛政策!

回覆 小王爺:政治層面太高遠,不是我們市井小民能參與的...

您錯解一些東西,所以產生判斷的偏差。沒辦法,西方的宣傳無孔不入,我跟您說說凱因斯的名言。這是蘇秦張儀之流的詭辯之術,不正面回應海耶克的提問,因為無法回答,反而提出,長期來看,我們都死了。因為人都會死,所以這句話沒錯是正確。但是也意味著,他所提出的解方並不是解決長期的問題,只能是處理短期問題。這才是凱因斯的真實回答,他要大家活在當下,只處理眼前的問題。無怪乎,培養了一批又一批專門處理短期問題的學者,短視近利。換一句現代通俗話講,叫做債留子孫。石油只要用美元去買賣,美國不會管你們高興賣多少,高低起伏是商人要賺期貨的價差。低油價除了打擊產油國的敵人,還有一種新能源的敵人。這些才是政治戰略真正會考慮的問題。絕非債股市或是公開市場資訊那些把結果當原因分析的專家。

回覆 歸休:石油交易是一種必需資源的分配,政府官營乃...

二年前,俄羅斯正享受高油價帶來的經濟美景,

油電大亨富可敵國,

強權擴張政策大張其鼓,伸手烏克蘭,

接下來,美國對油價下重手,

去年初俄羅斯發生了什麼事?

鼓價腰斬腰斬再腰斬。

請注意接下來他們貨幣政策做何因應?

此時外資內資因盧布狂貶而大逃亡,於是將利率暴升至19%先求止血,

再加上歐盟禁運令,要不是有中國撐腰,

普丁政權撐不撐得過還有變數。

看到各位討論到貨幣緊縮政策可能已緊鑼密鼓,

我首先想到的是,這次主要是針對誰?

中國顯然不像會受重傷,

沒錯地方債連結房市泡沫風險極高,

但央行實力堅強,先買單壓下來,再利用處底位的股市做出牛勢,

資金出逃應該對付得了。但貶值是理所當然的。

但歐盟扛得下如同俄羅斯那般的利率嗎?

回覆 小王爺:政治層面太高遠,不是我們市井小民能參與的...

其實 ,若只是要談黃金,能不能解套 ,我是不擔心的,下星期應該就是我的進場點 ,抱著它 ,再震兩三個星期吧,然後就等 (我個人做法 ,不建議)。但因貨幣政策 ,所牽涉的是各國的消長,對於還有其它投資的部位 的人來說,一不小心 ,就會踩到地雷!例如 ,已經創新高的道瓊 ,按波浪是,下次修正完 ,還要再漲很大一波 ,但現在看空的人已高達6成 ,很難理解如何大漲 ,不腰斬就不錯了 。可是如果是政策所帶來的資金聚集效應 ,那就不難理解 ,那這對新興市場的陸股有啥影響 ?大家都知道 ,陸股在磨中長底 ,房市的調控 ,只會利多股市 ,但是要先下到 2600, 才起漲 ,還是橫盤再漲 (陸股的外資很少) 是2017 上半年 ?下半年 ?。相對陸股 ,外資佔有很高比例的台股呢 ? 其實是我太晚發現這件事 ,不然 ,我不會在 10/12 前 ,進場買黃金的 ,因為 10/14 前後幾天才是最佳進場點 (當然你也可以說我事後諸葛) ,這件事 ,也讓我長一智 。要在茫茫的海中生存 ,身為小魚的我 ,沒啥技能 ,只要會逃生 ,或順流就好 ……謝謝各位意見的交流 ……

回覆 金正夯:其實 ,若只是要談黃金,能不能解套 ,我...

別誤會 ,我沒看空台股哦 ……只是觀察 ,何時可進入 。 很多報導都在討論幾個月的非農 ,臨時工的比例阿 ……薪資的增長阿 ……結果是看壞未來就業成長 ,那美聯儲真的想在 12月加息嗎 ?還是如葉倫所說 ,美國其實還有其它手段,其實這次資金監管就是變相縮減QE (再者 ,日本央行可買股市 ,美聯儲不行 ,若未來修法可以 ,那道瓊要上 30000),所以 ,美儲救市應該還有很多辦法 ,大家都預測要加息 ,但美國前財務部長Summers (競選主席輸給Yellen) ,不斷上電視警告Yellen 不要為了面子加息 。所以 ,情勢 ,還有的玩 ……

回覆 金正夯:其實 ,若只是要談黃金,能不能解套 ,我...

黃金能不能解套,要看買進的價格…。問題我天達是買在50.7美元/單位,但是現在是43.75元左右…。我當然也不擔長久以後究竟能不能解套,問題是9月底美聯儲不加息到12月16日宣佈加息可能性之前這一波abc波我沒賺到啊…。(如果從43~60元我還在腰部進帳一點,萬一只升到53、54元我這兩個月等於白進場了。很少看到摜壓之後才把前波低點作高點的陽春漲法…。這一波只有新生才能賺到的波段…。有人說對充基金被斷頭我相信,至於flash boy密集交易?還結合電子交易盤來看咧?妳看到有分好多次放空的痕跡嗎?沒有…。還有人講期貨盤?12月金價下跌幅度也沒有SPDR來的大呀?我看可能就是歐盟金融業危機影響的,11月還要清算義大利,義大利可能用下一個脫歐來威脅要賴帳外債,9月底到12月的波段目前看來很不美…。

回覆 小王爺:黃金能不能解套,要看買進的價格…。問題我...

似乎炒空已成風潮,以下轉載和訊網:

近日跟一些交易員聊起關於此次大跌,有朋友認為我之前關於人民幣加入SDR之後需要付出一定「代價」的分析邏輯是成立的,黃金和非美貨幣確實要承受一定的做空壓力。一方面美元要展現其霸主地位,對沖市場對人民幣加入SDR的「吹捧」,需要進一步體現對非美貨幣的絕對優勢,加快釋放加息信號無可厚非;另一方面對全球其他經濟體的風險問題需要進一步擴散,包括英國脫歐對英鎊帶來的風險,以及對中國債務和房地產市場的警示,也可能是導致中國假期內英鎊、人民幣離岸匯率等大幅波動的原因。

另外我還聽到這樣一個消息,近年來國內出現了一批黃金市場的職業炒家,這批炒家來自東南沿海地區,時常利用國內和國際市場的價格、匯率、交易時間等不對稱性,做跨國套利交易。這批炒家在國際盤面有數十億美元資金,往往可以在短期內制造恐慌,甚至有能力「操縱」國際金價短期走勢。

幾個交易員提出了這樣的假設,如果在國慶假期之前在國內期貨和現貨市場布局巨量的空單(中國國慶假期休市之前金價已連續下跌四天,空頭市場已有所形成,布局空單風險並不大),然後在假期國內停盤期間,動用國際資金在國際高槓杆市場大幅做空金價,致使恐慌性下跌,推動恐慌情緒蔓延,待國內開盤後多頭將遭到重創,空方將獲益頗豐。

事實上10月7日晚(周五),本來市場面臨翻盤,因為美國公布的非農數據差於預期,金價一度攀升至1265美元/盎司,如果金價持續上漲至美國收盤,周一(10月10日)中國市場開盤後恐慌情緒將大幅下降,跨國炒家們持有的空單未必有理想收益。而就在市場情緒迅速翻轉的時候,北京時間周五23:30左右,在沒有任何巨大利空消息的情況下,美國黃金期貨市場卻在在一分鍾內出現了名義價值高達22.5億美元的拋售,導致金價迅速回吐漲幅,跌破1250美元的重要關口,最低下探至1243,有所恢復的市場信心再次受到重挫。

受到巨額空單的影響,直至周五收盤,國際金價也沒有收復1260美元。如不出意外,下周一開盤後,中國黃金交易市場將會出現恐慌性拋售,大量的多頭不得不斬倉離場,空頭們將大賺一筆。

假設這一次大跌有跨國炒家的「添油加醋」,中國投資者需要注意,不要輕易認虧斬倉,補足保證金等待機會,時間在多頭一方,坐等空頭美夢破碎。

回覆 小王爺:黃金能不能解套,要看買進的價格…。問題我...

嘿嘿嘿,看了你的"9月到12月這波沒賺到" 和"白進場理論",我想這就是投資市場上,充滿各種不同的心態與做法。大家都知道,我羨慕會做短線的人,因為我是做中長線的,做短線會猶豫不決。接下來,我想分享一篇我很喜歡的文章,沒有任何惡意與貶低,只是分享....

投資是一場長途跋涉,不能老指望搭上順風車,更不能出現一次車毀人亡。關鍵是持續前行,使命必達。

以天為單位看待收益的人,相信的是奇蹟和運氣;

以年為單位瞄準收益的人,相信的是天賦和能力;

以3-5年為周期規劃財務的人,相信的是膽識和眼光;

以10年為單位思考財富的人,相信的是常識和複利;

以更長周期看待財富的人,相信的是時代和命運;

很多事情,不是從學識智商分野,而是從格局開始的。

投資長期來看只有兩個因子是核心且恆久的:第一是價值,第二是人性,其它一切都只是次級因子。次級因子對於價值和人性的干擾機制是非常複雜的。

站在今天看宏觀經濟的疲弱、匯率市場的波動、金融槓桿的參與等等次級因子都使得市場處於非常複雜的擾動內。我們需要思考的是未來內在價值會哪些地方、以何種方式繼續增長?以及如何至少不被恐懼和貪婪所傷害?今天的這些思考和結論,可能決定了3年後資產的狀況。

剛在書里看到一句挺有趣的話:

「分析師有什麼用?股市漲的時候誰還需要分析師?」

「如果股市跌了呢?」

「那時候誰還需要股票?」

其實大多數人的財富都是時代給的,特別是要敬畏周期。「永遠繁榮下去」的幻象背後是缺乏常識和自大,在繁榮的頂點上槓桿更是典型的財富自殺行為。

大多數人往往認為投資的最高境界是「入手就漲」,其實投資真正的奧義是「入手就贏」。這一字之差其實反映的是認知層次上的天壤之別。

前者是被市場牽著鼻子走,試圖做日常市場波動的主人

後者是立足於堅實的安全邊際和妥善的賠率測算,是做自己行為的主人。

一切結果的差異本質上都是思維方式的差異。

今年的市場,甭管您是持幣還是持股,被折騰被糾結都是必然的。從周期的角度來看,未來較長一段時間那就是反覆糾結折騰的階段,這是進入未來掙大錢階段的必然準備。這種時候,高度關注市場基本上很容易整成神經病。主心骨還是從機率賠率的價值觀點出發,穩健策略下配合耐心和平常心慢慢熬。

但更難的,是在多輪的牛熊轉換和各種行情變幻中克服恐懼貪婪,看清自己並知行合一。

而最難最難的,是用一輩子的時間堅守並簡單重複那些最初的道理。

資產配置這事兒沒必要天天琢磨糾結,但在大周期的判斷上一定要清醒,因為那決定著10年後你資產的安全性和可能性。

真正的交易區間只占整個投資時段大約不足10%的部分,所以安排好其它90%的時間不但影響著你的投資回報還決定了你的幸福指數。除了必要的學習思考做做功課外,最好是把自己的生活安排的儘可能的舒服:鍛鍊身體,隨性旅遊,讀書看電影,做點兒自己喜歡的事,這樣即便是平庸的回報你都賺到了人生。如果恰好方法對路判斷正確,那就是物質精神雙豐收了。

對老手的建議:張弛有度,平常心加耐心;對新晉投資人的建議:抓緊學習進階,下一波你就不會缺席;對韭菜們的建議,地球很危險還是回三體星吧。

回覆 金正夯:嘿嘿嘿,看了你的"9月到12月...

我看多黃金,但不排除"這波黃金只是B波大反彈",我相信自己的看法,但絕不死多頭,所以在所謂的底部 1220-1240 (說不定不會來,但我在等再打一次腳),我會加碼,但我不會滿倉,反而往上突破多空轉折時,才會再加碼。這樣我一定是買在比較高的位置了,但確認了,黃金多頭趨勢沒變,反之,一旦我確認空頭成立 (gdx 破19.6),我會停損出場,但繼續定期定額....

同理可證,我看多陸股,但不排除,它還在熊市的最後一個階段 (因為它月線和周線趨勢往下),如果是如此,10- 11月要賣 (上證 3100-3200),明年6月再進場...

回覆 林立伶俐凌厲:哈哈,gdx破24.0,我出場空手。總之...

我10/14 ,進場買gdx 22.7 ,把賺的部份先出了。總體來說(包含黃金基金),9月底與10月買的,目前已經扯平了(含手續費),預計過些天再賣剩下的,原因是,現在百分之70的多頭,都在等更低的一支腳 (所謂的C -wave ),有人看 1220, 有人看1180。那如果大家都出場去等低點,可是價格卻跌不下去呢? 所以,我賭大選前的氛圍 , 如果最後還倒賠一點,哪那也就認了⊙⊙不建議大家像我一樣任性喔。至少,這一波攤平成功,少賠很多了。林利,你比較果決,我則在實驗自己的看法,觀察11月底-12月的買點,預計明年2月再進場。

回覆 傑伊 :正夯,寫的超好@@ 感謝,向你致敬㊣...

哈哈哈,那是別人的文章,我只是分享 ,我喜歡閱讀很多書,文章,分析。與大家分享一個我最近的心得....,我8月初,就一直在糾結1375是不是C浪頂,是按波浪,在9月中,其實趨勢就很明顯,那時我空手了,就不應該再進場。最後印證,真的修正到1250, 所以,技術面還是很重要。因此,我和朋友認真的回歸波浪理論,我們的結論如下 (僅供參考) : 今年初到2018年的黃金,就是個B波大反彈,2017 會漲到1484左右,2018漲到1588, 再來就要一路跌到2023年初的 681。這是純粹波浪理論,不包括外面局勢與基本面,所以僅供參考用。

回覆 Ang:哈哈!妳好久沒浮出來了,真的,若有突破前...

行情就那樣,之前就說,10/14 是最佳買點,沒啥變化,所以就沒什麼好說了。

因為9月下旬和十月初 (跌破1270) 買的,被套住了,損失約12%

因此,10/14 先做一趟 gdx 抄底,吉拉德宣布維持QE時,1270 gdx 全部出場,

賺來補黃金基金的損失。但黃金基金,還留著,這兩天,沒有任何的動作。

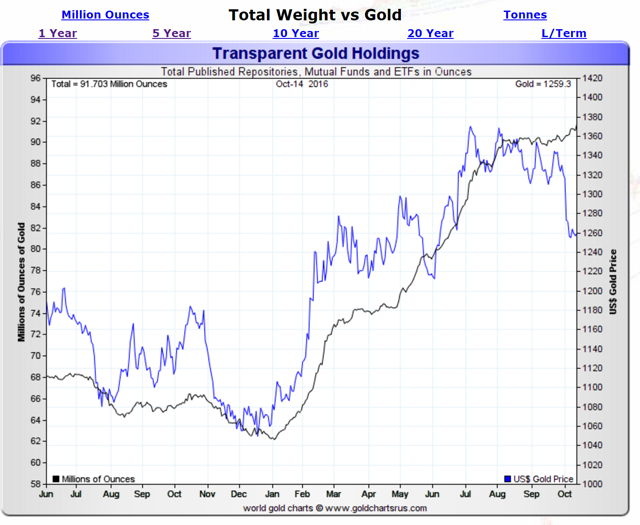

因為,我看了兩個人的籌碼分析 (COT + GLD),覺得黃金還有戲, 所以,先看多...

Adam Hamilton (今年黃金趨勢轉折都預測對的人) 寫得非常好

Gold Green Lights Upleg

Adam Hamilton October 21, 2016

Gold’s early-October plunge on futures speculators’ stop losses being run has naturally left this metal mired in battered technicals and bearish sentiment. But that sharp selloff has already accomplished its rebalancing mission. The excessive gold-futures trading positions that triggered that stop running have already reversed, and the investors fueling gold’s bull are starting to buy again. Gold is green lighting its next upleg.

Gold’s price action in recent years has been overwhelmingly dominated by just two groups of traders. Gold-futures speculators effectively control gold’s short-term behavior, as futures’ extreme inherent leverage gives their capital wildly-outsized influence. And investors, specifically American stock investors buying and selling shares in the flagship GLD SPDR Gold Shares gold ETF, have commanded gold’s longer-term moves.

Plenty of traditional gold investors don’t want to believe this, as it’s seen as paper gold overpowering the real physical market. While the gold futures that unfortunately rule gold pricing are definitely paper gold, GLD truly isn’t. This critical ETF acts as a conduit for the vast pools of American stock-market capital to flow into and out of real physical gold bullion. The interplay of gold-futures and GLD trading drives gold.

This dominant pair of primary drivers thoroughly explains everything that’s happened to gold in recent years. That includes the brutal bear market between 2013 to 2015, 2016’s young new bull, and even gold’s early-October plunge. Speculators and investors who want to multiply their capital in precious metals need to study gold-futures and GLD-holdings action. Both are now green lighting gold’s next major upleg.

While investors’ GLD-share buying is far more important to this gold bull’s ultimate size and longevity, the best place to start is speculators’ gold-futures trading. It was these traders’ excessive upside bets that spawned gold’s early-October plunge, and it will be their buying that ignites and initially fuels this gold bull’s next surge higher. Everything in gold-futures trading results from the extreme leverage inherent in it.

Each gold-futures contract controls 100 troy ounces of gold, which is worth $127,500 at $1275. Yet futures speculators are only required to deposit $5400 of capital for each gold-futures contract they are trading. That works out to extraordinary maximum leverage of 23.6x! For comparison, the legal limit in the US stock markets has been just 2.0x since 1974. Gold futures’ leverage is an order of magnitude greater.

At minimum margin, fully-leveraged gold-futures speculators risk losing 100% of their capital bet on a mere 4.2% adverse gold move! If gold moves more than that against traders, their losses can quickly snowball beyond 100% as margin calls force them to contribute even more capital. This extreme and unforgiving leverage inherent in gold futures forces their traders to maintain an ultra-short-term focus.

Unlike investors who own gold outright and have no problem weathering normal and healthy mid-bull selloffs, gold-futures speculators can’t afford to be wrong for long or they will be totally wiped out. The massive risk their extreme leverage entails greatly amplifies both their collective sentiment swings and trading action, leading to their decisions having a wildly-disproportionate short-term impact on the gold price.

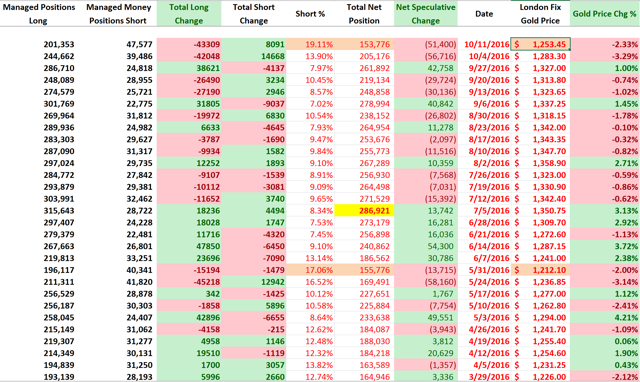

This outsized influence makes speculators’ total long and short positions in gold futures one of the best short-term indicators for gold prices. Their aggregate bets are published every Friday afternoon in the CFTC’s famous Commitments of Traders reports, current to the preceding Tuesday. And the latest CoT read before this essay was published, last Friday’s, reveals that gold-futures selling risk has radically abated.

The first chart looks at the collective gold-futures holdings of speculators, both large and small, from those weekly CoT reports. Their total long positions, which are upside bets on gold, are shown in green. Their shorts or downside bets on gold are rendered in red. Gold and some key technicals are superimposed over the top. The latest CoT data proved very bullish for gold, green lighting its next major upleg to get underway.

To understand this past week’s super-bullish gold-futures development, it’s necessary to first get some context. Back in early July, total spec longs surged to a staggering 440.4k contracts! Since every one controls 100 ounces of gold, that’s the equivalent of an enormous 1369.7 metric tons. That works out to almost a thirdof total global gold demand in 2015, a freakishly-huge upside bet given futures’ extreme leverage.

Our gold-futures CoT data goes back to early 1999, and specs’ extraordinary massing of longs in early July was easily the highest seen in that 17.5-year span and almost certainly an all-time record. These elite traders had gotten caught up in gold’s powerful post-Brexit-vote summer rally, which ran counter to its normal seasonal weakness. Their collective longs ballooned to records as they expected gold to keep surging.

Futures speculators as a herd make the same dangerous mistake as the vast majority of other traders, assuming already-mature trends can be extrapolated out into the indefinite future. They are the most bullish as evidenced by the highest long-side bets when gold hits major interim highs after strong rallies. Being bullish when everyone else is near greed-drenched toppings is exactly the wrong time to be way long.

So when gold starts moving against speculators’ hyper-leveraged gold-futures bets, they are forced to sell rapidly to avoid full-on annihilation. The maximum leverage in gold futures usually runs between 20x to 25x as maintenance-margin requirements are periodically adjusted by the futures exchanges. At 20x and 25x, a mere 1% drop in gold multiplies to scary 20% and 25% losses. At 2%, they hit 40% and 50%!

So when futures speculators are excessively long and gold moves against them, they have no choice but to exit fast. And this selling quickly cascades, exacerbating the resulting futures-driven gold selloff. The more long contracts speculators sell to get their capital out of harm’s way, the faster gold falls. And that triggers still more selling by other speculators, aggravating the downside in a powerful vicious circle.

The serious near-term downside risk specs’ record gold-futures longs presented to gold were very clear back in early July. In my first essay after gold soared to its $1365 bull-to-date peak back then, I warned in depth about gold’s record selling overhang. As long as futures speculators are excessively long, the odds favor even minor gold selloffs snowballing into something serious as these traders rush for the exits.

Gold-futures long extremes are usually short-lived, lasting a week or two before the cascading selling necessary to reverse them kicks in. Yet incredibly, gold-futures speculators were so bullish on gold that they ignored many things including surging Fed-rate-hike odds to maintain those high positions for a wildly-unprecedented 12 more CoT weeks! Spec longs defiantly stayed above 400k contracts for 10 of those.

That’s why gold consolidated high after early July’s bull peak instead of correcting like normal after a major bull-market upleg. Without gold-futures speculators liquidating their longs en masse, there was no material selling pressure on gold. After spec longs stayed near record highs for an entire quarter in the weak summer season despite mounting hawkish Fed expectations, they were actually starting to look sustainable.

While I warned about specs’ near-record selling overhang for weeks on end in our newsletters, after 13 consecutive weeks of them I was guilty of getting complacent too. But the necessary selling to reverse these excessive longs still finally arrived amazingly late in early October. As gold started to drift under its $1308 late-August pullback low for the first time on October 4th, gold-futures stop losses started to trigger.

In a realm as hyper-leveraged as gold-futures trading, maintaining automatic stop-loss orders on trades is essential for survival. Gold can move 2% fast, wiping out fully half of traders’ capital if they bet wrong in gold futures. Futures stop losses started triggering at $1305 that day, exacerbating the selling which soon forced gold under major $1300 support. That tripped many more stop losses, leading to a mass liquidation.

Cascading gold-futures selling quickly blasted gold down 3.3% on Tuesday October 4th, hammering it to a deep new pullback low of $1270. It’s critical to understand exactly what happened that day, so I wrote an entire essay on gold futures’ stops being run that week. But unfortunately despite that extreme down day that looked and felt like a climaxing capitulation, specs’ gold-futures longs remained far too high after it.

They were still way up at 379.1k contracts, which was still the 20th highest witnessed out of the 928 CoT weeks since early 1999. While specs had liquidated an enormous 33.0k gold-futures long contracts to drive that big down day, their longs still remained so high that they kept that vexing near-record futures-selling overhang largely intact. That implied the selling wasn’t over, and indeed gold was soon pushed even lower.

The next CoT report following the 4th’s was the 11th’s that came out last Friday afternoon, the newest CoT before this essay was published. And it proved astonishing! Gold only retreated 1.3% during that latest CoT week ending the 11th, less than a third of the 4.3% plunge of the previous CoT week. Thus there was no reason to expect to see speculators’ gold-futures long liquidation continue at any serious scale.

Yet incredibly despite gold’s relatively-mild drift lower, these traders liquidated fully another 42.0k long contracts! That was immense, actually the 8th-largest spec long dumping witnessed in those 928 CoT weeks since early 1999. The only larger single-CoT-week long liquidation in recent years was a 49.5k one in late May 2016. And that capitulatory selling frenzy by futures speculators heralded a major gold bottom.

Last CoT week’s epic long liquidation hammered specs’ total gold-futures longs back down to 337.1k contracts. That’s right under the 340k-contract major support zone this young new gold bull has enjoyed since April. So the record and near-record gold-futures selling overhang that has kept a lid on gold since early July has essentially fully reversed! It is no longer a threat, as speculators now have firepower to buy.

These elite traders now have room to buy over 103k gold-futures contracts just to push their collective bets back up near early July’s levels! That’s the equivalent of 321.3t of gold. The entire 29.9% gold bull so far between mid-December and early July was partially driven by futures specs buying 249.2k long contracts while covering 82.8k short ones. So now having room for 103k contracts of long buying is very bullish.

But it gets even better. Specs also added 8.0k short contracts last CoT week, taking their total to 115.9k. That’s the highest since gold was bottoming in late May just before its sharp summer upleg. Support levels of spec gold-futures shorts have been running around 95k contracts in this young bull. So gold is also poised to enjoy another 21k contracts of futures buying on short covering as it inevitably starts rallying again.

So in just the last two CoT weeks, speculators’ collective gold-futures positions have swung from a near-record selling overhang of longs and relatively-low shorts to about 125k contracts of near-term buying potential! Gold’s bull-market uplegs are almost always initially sparked by spec futures short covering, which has the same upside impact on gold’s price as new long buying. Then long buying accelerates the upleg.

The fact gold is now seeing its most-bullish gold-futures setup since late May just ahead of its last upleg is super-bullish. Futures are now green lighting gold’s next major upleg. Technicals back this too, with gold holding near its 200-day moving average since its early-October plunge. 200dmas are always the strongest support zones within ongoing bull markets, with stellar probabilities of stopping selloffs cold.

With gold-futures speculators’ collective bets no longer excessively bullish and holding back gold, that paves the way for major investment buying to resume. It is these investment-capital inflows, through that leading GLD gold ETF in particular, that have been responsible for the great majority of gold’s new bull market this year. GLD acts as a direct conduit for stock-market capital to buy real physical gold bullion.

GLD’s mission is to track the gold price, but its shares have their own unique supply and demand that is totally independent from gold’s. So when American stock investors buy GLD shares at faster paces than gold itself is being bought, they will soon decouple to the upside. The only way GLD can keep on mirroring gold is if that excess differential buying pressure is equalized directly into the underlying gold market.

So when GLD-share demand exceeds gold’s, this ETF’s managers are forced to issue new GLD shares to offset this excess demand. Then the resulting proceeds are immediately used to buy physical gold bullion that is held in trust for GLD’s shareholders. Thus GLD’s holdings, which are published daily, reveal whether stock-market capital is flowing into or out of gold. They too are green lighting gold’s next upleg.

Without 2016’s massive buying of GLD shares by investors, there’d literally be no gold bull. And that is not hyperbole or exaggeration at all. Gold soared 16.1% in Q1’16 and 7.4% in Q2’16 almost exclusively because GLD’s holdings skyrocketed 27.5% and 16.0% on heavy stock-market-capital inflows into this ETF’s shares. The World Gold Council’s global fundamental gold supply-and-demand data proves this.

Per the WGC’s definitive research, worldwide gold demand surged 20.5% or 219.4t year-over-year in Q1’16. GLD’s gargantuan 176.9t holdings build alone in Q1’16 accounted for a whopping 80.6% of that total global growth in gold demand! GLD’s incredible dominance over gold grew even more complete in Q2’16, where world gold demand climbed another 15.4% or 139.8t YoY. GLD’s Q2’16 build was 130.8t.

Thus differential GLD-share buying by American stock investors was responsible for a staggering 93.6% of the total global increase in gold demand in Q2’16! So truly without American stock investors buying GLD shares faster than gold was being bought, gold’s bull would’ve never been born. The fundamental reason it stalled in Q3’16 is GLD’s holdings actually fell 0.2% or 2.1t as stock investors’ capital inflows ceased.

I wrote a whole essay on this GLD-driven gold-bull stalling in mid-September if you’d like more detail. In a nutshell, record stock-market levels retarded gold investment demand. As stock markets soared to new record highs after their sharp post-Brexit-vote selloff, investors’ desire to own gold waned. Since it tends to move counter to stock markets, gold demand for prudent portfolio diversification temporarily evaporated.

On October 4th as gold plunged, I knew cascading gold-futures selling had to be the culprit as I wrote to our newsletter subscribers that very afternoon. But my biggest fear that day was such intense futures selling would scare investors into joining in. If they started fleeing, gold’s bull would face serious risks of being snuffed out. So it was a big relief to see GLD’s holdings dead flat on the 4th and the next couple trading days.

Instead of spooking investors, the sharply-lower gold prices from that gold-futures stop running actually encouraged them to buy! GLD’s holdings surged by 1.2% just a few trading days after that plunge on the 7th. American stock investors were buying more gold via GLD shares than the futures speculators were dumping. That trend wonderfully continued this week, with more GLD builds despite gold lingering near lows.

Thus so far in young Q4’16, GLD’s holdings have already climbed 2.0% or 19.3t despite the sentiment damage wreaked in early October. Amazingly this big early-Q4 GLD build is right on pace with Q1’16’s 19.7t by this point, which proved a monster quarter of differential GLD buying catapulting gold higher. And Q4’16’s quarter-to-date 19.3t build is vastly superior to Q2’16’s 14.3t draw by this point in that quarter.

So American stock investors’ differential GLD-share buying, the overwhelmingly-dominant force behind this year’s young new gold bull, is resuming at a major scale! This has also green lighted gold’s next major upleg, which is likely already underway. As today’s fake Fed-levitated wildly-overvalued US stock markets inevitably weaken, and gold enters its strongest time of the year seasonally, investors are buying again.

Thus the forces that drove gold’s high consolidation in Q3’16 followed by early-October’s plunge have already reversed. Speculators’ vexing near-record gold-futures selling overhang has finally just been eradicated, leaving them positioned to be aggressive buyers again. And investors’ mid-year break from gold buying that stalled out this young bull appears to be over, as the critical GLD builds are resuming.

Gold’s next upleg can certainly be played with GLD, but this ETF will merely pace gold’s coming gains at best. Meanwhile the stocks of the elite gold miners will really amplify gold’s upside due to their great inherent profits leverage to gold. And as I discussed in depth last week, the gold stocks are screaming buys today with gold’s bull entering its next major upleg. The window to get deployed at relatively-low prices is closing.

At Zeal we’ve spent literally tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. This has resulted in 851 stock trades recommended in real-time for our newsletter subscribers since 2001. Their average annualized realized gains including all losers are running way up at +24.1% as of the recent end of Q3! Why not put our expertise to work for you?

We’ve been aggressively adding gold-stock and silver-stock trades since early October’s anomalous plummet, taking advantage of this incredible buying op. These new trades are already detailed in our popular weeklynewsletter, and coming soon in our monthly. Both draw on our vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today! For just $10 an issue, you can learn to think, trade, and thrive like a contrarian.

The bottom line is gold’s overwhelmingly-dominant primary drivers are both green lighting a major new bull-market upleg. Futures speculators’ excessive longs have been liquidated back down to bull-market support, while their shorts surged near bull-market resistance. That leaves these key traders with great buying firepower for the first time since late May, just before gold’s last major bull-market upleg got underway.

Meanwhile American stock investors have started heavily buying GLD shares again, fueling this ETF’s big early-quarter holdings build equaling Q1’16’s massive jump that ignited gold’s young new bull. If this resumption of investment-capital inflows into gold persists, they will again drive its next major upleg. Contrarian speculators and investors can still buy in relatively low before the rest of traders figure this out.

回覆 金正夯:行情就那樣,之前就說,10/14 是最佳...

另外一篇是 Hebba Investments (也是分析籌碼的),因為8/9月他們都看空,現在看多,

請參考,不一定準 (其實現在也沒人說得準 C修正浪來不來,修正多深)

放上英文標題,英文好的人,請欣賞,英文較弱的,可以上網Google標題,按右鍵,

選擇翻譯中文,大約可了解說啥。沒太多意外,最近不會有啥動作...

We Are Putting Ourselves Out On A Limb And Calling A Gold Bottom, And This Is The Reason Why

Summary

The latest COT report shows that speculators continued to close out gold positions at an extremely fast pace.

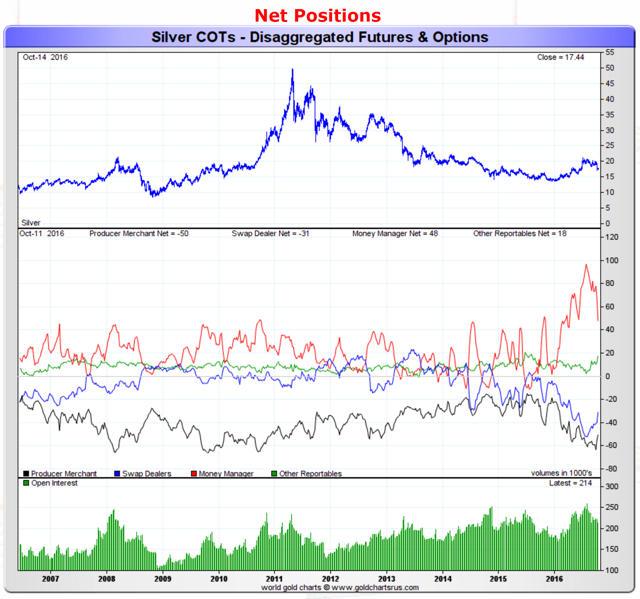

Despite the drop in gold, transparent gold holdings have actually increased over the past few weeks in contrast to what gold did during the 2013 drop.

This suggests that much of the gold drop may be due solely to speculators and now we are at much healthier speculative net long levels.

Premiums are rising for gold in India and China.

We think now is the time to buy gold as all of the evidence suggests a short-term bottom in gold rather than a new bear market.

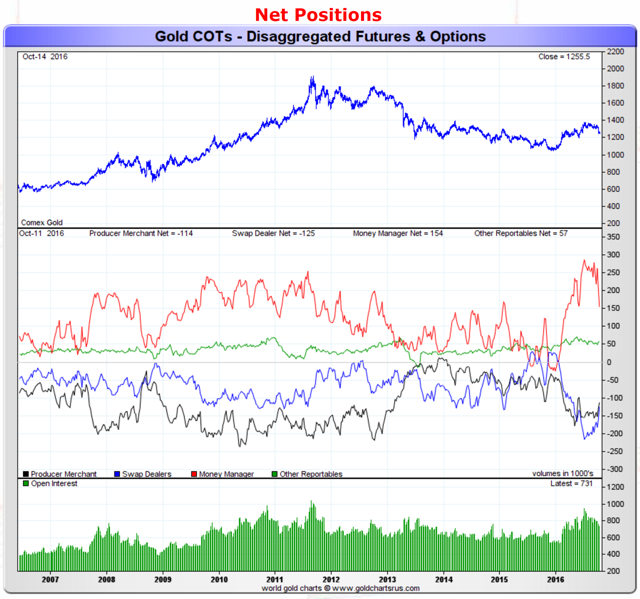

Another big move by speculators as last week saw speculative positions in the Commitment of Traders (COT) report reach levels they haven't seen in months - and they did it in a very volatile way. Silver saw even greater action as those traders abandoned positions at an even greater rate than gold, which took down the net long speculative silver position to levels that are much healthier than we have seen in months.

We will also take a look at the "transparent gold holdings", which are the amount of gold held by repositories, mutual funds, ETFs and electronic precious metal sources across the world. That will give us an idea of what has really been behind this recent drop in gold.

While this week's drop was vicious for gold bulls, for long-time followers it should come as no surprise as we have been waiting for this drop for quite some time. We will take a look at speculative positioning to try and see if this is a good opportunity to buy gold or if there may be more downside, but before that let us give investors a quick overview into the COT report for those who are not familiar with it.

We will get a little more into some of these details but before that let us give investors a quick overview into the COT report for those who are not familiar with it.

About the COT Report

The COT report is issued by the CFTC every Friday, to provide market participants a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC. In plain English, this is a report that shows what positions major traders are taking in a number of financial and commodity markets.

Though there is never one report or tool that can give you certainty about where prices are headed in the future, the COT report does allow the small investors a way to see what larger traders are doing and to possibly position their positions accordingly. For example, if there is a large managed money short interest in gold, that is often an indicator that a rally may be coming because the market is overly pessimistic and saturated with shorts - so you may want to take a long position.

The big disadvantage to the COT report is that it is issued on Friday but only contains Tuesday's data - so there is a three day lag between the report and the actual positioning of traders. This is an eternity by short-term investing standards, and by the time the new report is issued it has already missed a large amount of trading activity.

There are many different ways to read the COT report, and there are many analysts that focus specifically on this report (we are not one of them) so we won't claim to be the exports on it. What we focus on in this report is the "Managed Money" positions and total open interest as it gives us an idea of how much interest there is in the gold market and how the short-term players are positioned.

This Week's Gold COT Report

As investors can see, this week's report shows that speculative longs plummeted for the second week in a row by more than 43,000 contracts on the week. On the other side, speculative shorts once again took advantage of the drop in gold to increase their own positions by 8,091 contracts on the week.

We also want to point out to investors that short interest as a percentage of total speculative positions reached 19.11%, which is the highest since early February's 23.45% when gold was trading at $1209.50.

Moving on, the net position of all gold traders can be seen below:

Source: Sharelynx Gold Charts

The red-line represents the net speculative gold positions of money managers (the biggest category of speculative trader], and as investors can see, speculative traders once again significantly decreased their positions for the week as they ended at a net long of around 154,000 contracts.

What that means for gold bulls is that we are now at much healthier positions in terms of speculative traders then we were a month earlier as a 154,000 net long speculative contract position is around the average of what we saw during the 2009-2011 portion of the gold bull market.

Even more interestingly, the net Producer/Merchant stands now at a net short position of around 114,000 contracts - which is actually towards the low end of what we saw during the 2009-2011 gold market. That's a positive factor as it suggests producers and merchants, who know the ins and outs of the physical side of the gold market, are more bullish than they have been in the previous gold market - that is a big positive.

As for silver, the action week's action looked like the following:

Source: Sharelynx Gold Charts

The red line which represents the net speculative positions of money managers, saw a large decline on the week of around 18,000 net contracts - which is an extremely large proportion of total outstanding silver contracts as it represents close to 10% of outstanding contracts compared to gold's net drop which was about 6% of outstanding gold contracts. This shouldn't be too surprising because silver dropped from $18.74 to $17.48 during the COT week which closed on Tuesday October 11th. The speculative net silver position is still a bit high compared to historical terms, but we are at much better levels then we have seen previously. Also, since silver closely tracks gold and gold is at much healthier speculative levels, we wouldn't be surprised if a gold rebound would bring silver up with it.

A Look at ETF Holdings

Before we close this piece we wanted to take a look at total published gold holdings over the past year, and especially focus on the last month.

Source: Sharelynx Gold Charts

As investors can see above, despite the big drop in the gold price transparent investor gold holdings have actually increased over the past few weeks. In numeric terms, transparent gold holdings have increased by around 1.5 million ounces (around 1.7%) over the past four weeks despite the drop in the gold price.

Taking a look at the same chart over the past five years we see the following:

Source: Sharelynx Gold Charts

Investors can see that during the big price drop in gold from the middle of 2012 through 2015, the gold price dropped and investors holdings followed it down. It may be still a bit early, but we have not seen the same thing happen with this price drop as we have actually seen the opposite happen - transparent gold holdings have RISEN during the drop in the gold price.

What does this tell us?

It tells us that the recent drop in gold was not due to ETF liquidation of gold holdings as holdings have not declined. Pairing that information with the information from the COT report, that speculative investors have massively cut gold positions by close to 50% from their highs in early July of around 287,000 net long contracts to the current positions of only 154,000 net long contracts, and this gives strong evidence that the gold drop was mainly due to speculators cutting back on their gold positions.

Conclusion for Gold Investors

While nobody can really know a bottom until after it happens, we think there is a high likelihood that the recent drop in gold has run its course. We know we are putting ourselves out there, but we come to that conclusion because we are only seeing speculators unload positions to levels which are much healthier and actually lower than we have seen in the previous gold bull market. Additionally, since we are not seeing any follow-through selling in transparent gold holdings, we think that many of these speculators may jump right back in to gold if the price doesn't continue to decline.

Finally, we just published another research piece on the physical side in terms of demand from India and China, and what we seem to be seeing is that premiums are rising in those Eastern gold markets for the first time since earlier in the year when gold was at much lower prices. This is a big positive as it would be a source of demand that we haven't seen in months, and would at least provide support to gold.

Thus we are going to put our necks out there and step out on that limb to say we think all the evidence points to a gold bottom here. For those investors that heeded our advice and sold over the past few months, we think now is the time to be buying back positions to previous portfolio levels in the gold ETFs such as the SPDR Gold Trust ETF (NYSEARCA:GLD], ETFS Physical Swiss Gold Trust ETF (NYSEARCA:SGOL], iShares Silver Trust (NYSEARCA:SLV) especially considering the important upcoming catalysts (the US presidential elections, the Italian Referendum, European banking shortfalls, etc.) that could benefit gold.

回覆 傑伊 :夯同學, 那您經驗判斷外國人英文網站的先...

您的留言讓我想起一句成語,白首為郎。這個典故出自《漢武紀事》。漢武帝曾經乘輦到郎署,看見一老翁,須鬢皓白,衣服不整。武帝問他說:“你何時當郎官,這麼老!”回答說:“我姓顏名字叫駟,是江都人,在漢文帝時作郎官。”武帝問:“為什麼這麼老沒有得到重用呢?”顏駟回答說:“文帝好文,而我好武;景帝好老,而我還年輕;陛下好少,而我已老。所以三代遭遇不好,所以老在郎署。”武帝被他感動,提拔他為會稽都尉,但是也僅止於此。 後人用“白首為郎”比喻遭遇不好,人才長久被埋沒。這就是「白首為郎」的典故,寓意人的一生,有他的宿命難違。顏駟好武,終生不改其志,然而生不逢時,有志難伸。對於顏駟來說是他個人的不幸,但是他堅持好武的志向,一生都沒有改變,真正改變的只是時代潮流的主流觀點而已。有感而發,請勿見怪。

回覆 傑伊:用240分線觀察gold ,...

個人認真考慮在今天或星期一會把黃金基金賣了 (定期定額續扣),因為黃金股票看起來比現貨弱很多(和陸續供佈第三季業績有關 ,像昨天newmont 業績遠不如預期)。所以,未來就算現貨繼續反彈 ,gdx 可能也會漲不太動 , 但未來 ,現貨若修正 ,gdx 可能會修正更多 (更何況 ,世界的股票在高檔)本來靠著gdx 抄底小賺 ,現在可能要小賠出場了 ,期待反彈給我賣 ^_^ 如果這次賣了 ,我希望gdx 21.5 左右進場 PS. 我觀察許久發現 ,貝萊德黃金基金現值 ,和澳洲 newcrest mining 的走勢有很大的相關,比 gdx 大 。所以,我買賣貝萊德 ,會觀察它當天的走勢 ……

回覆 真實與真相:"2018漲到1588, 再來...

哈哈哈,果然是 goldbugs , 只是,就算黃金最後要漲到 2000, 中間總要修正唄,修正起來粉可怕的

這問題要分三點看:

1. 因為我只買GDX 或黃金基金,因此,我的所看法,都是以 GDX 或黃金基金為出發點

(黃金1200 元時,金礦公司每盎司賺 100 元,但金價 1300 元時,金礦公司就賺 200,

這是 double, 所以金價漲 10 %,金礦公司可以漲 50%-100%,這是槓桿)

假設本波低點為 1200-1220,黃金回檔5%,但GDX 要回檔 12%-15% ,所以,我傾向避開

2. 我認為本波反彈尚未結束,但GDX 已經先破 200 MA, 例如,現在 13:16, 黃金已漲到 1271.85

(今天整天都很爭氣) 但澳洲金礦股 newcrest mining 卻很弱

3. Probability vs. Certainty (概率 VS 100% 肯定)

我看好 2017 的起漲點 (我的關注點: JPY 92 或 美指 104,GDX 21左右),無所謂,反正,先把 2016過完,做完2017 再說, 至於最後黃金要到 2000 或 1580, 順著趨勢走就好。

幾天前,我可以確定黃金現貨會繼續反彈,而非 1274 摔下來就結束 (當天賣掉GDX,純粹是獲利了結),卻沒料到金礦股的持續弱勢。拿黃金基金實驗自己的看法,看對了趨勢卻賠了錢,就認了... 反正,這幾天,有反彈就先出..

我還是看好黃金會突破 1275 往 1280 前進,純粹交流,無傷大雅