交易所交易貴的金屬基金(ETF)在周五領漲。

在周五表現最佳的非槓桿型ETF中,ETFMG初級銀礦股ETF(NYSEArca:SILJ)上漲4.0%,VanEck Vectors黃金礦工ETF(NYSEArca:GDXJ)上漲3.9%,Global X Silvers礦工ETF(NYSEArca:SIL)上漲3.5%,VanEck黃金礦業ETF(NYSEArca:GDX)上漲2.8%。

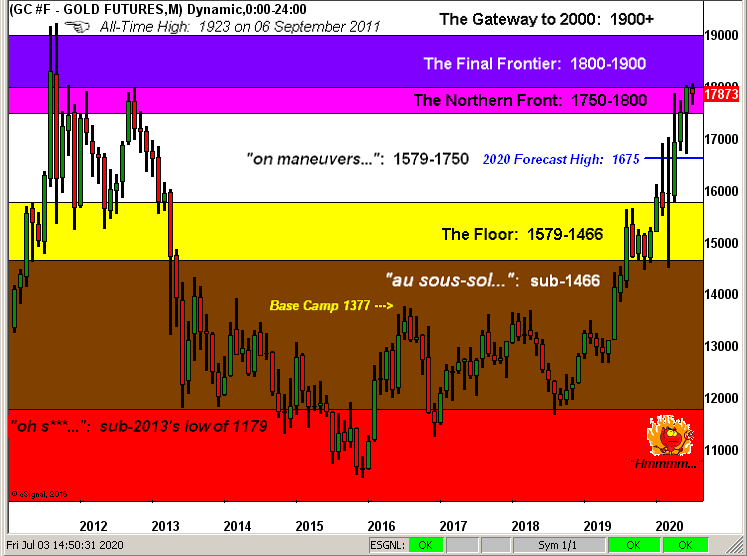

同時,SPDR黃金股(NYSEArca:GLD)上漲 0.8%, iShares白銀信託(SLV)上漲1.5%,Comex黃金期貨上漲0.6%至1,811.5美元/盎司,Comex白銀期貨上漲0.9%至19.8美元/盎司。 。

As long as we don’t have a vaccine, we will continue to have these problems… We could see a push towards $2,000 before the end of this year. 貴金屬交易商MKS SA高級副總裁Afshin Nabavi對路透表示:“只要沒有疫苗,這些問題就無法解決……今年年底前價格可能推高至2,000美元。”

。。。

Negative real interest rates, ballooning central bank balance sheets, weaker U.S. dollar and still-rising COVID-19 cases are enhancing the safe-haven appeal of the yellow metal. 實質負利率值,央行資產負債表不停膨脹,美元走軟以及COVID-19病例持續攀升,這一切都增強了黃金避風港吸引力。

Heightened tensions between the United States and China are also [causing] some to hedge more with gold in fear of another trade war that could stifle the global economic recovery美中關係緊張升級,另一場貿易戰可能扼殺全球經濟復甦,有此懸念的因此購買更多黃金避此險。

有關貴金屬市場的更多信息,請訪問我們的貴金屬類別。